At long last the government shut-down of 2025 ends as President Trump Signs legislation extending funding for most governmental agencies. As a result, the Internal Revenue Service (IRS) almost immediately announced the annual cost-of-living adjustments to the dollar limits applicable to employer sponsored retirement plans. Previously the limits for welfare and fringe benefit plans for 2026 had been amounts, and the Social Security Administration (SSA) had announced the taxable wage base amounts for 2026.

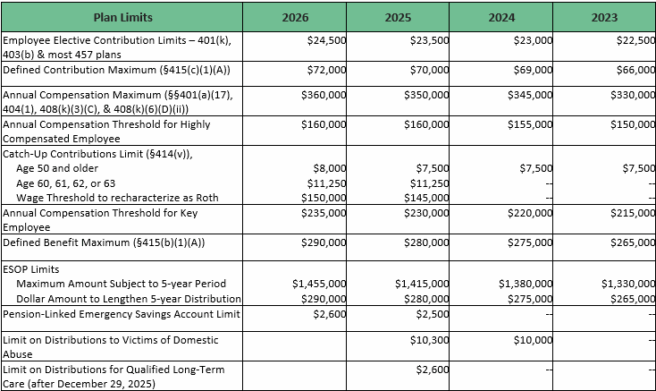

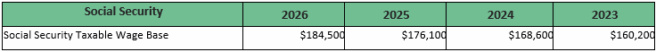

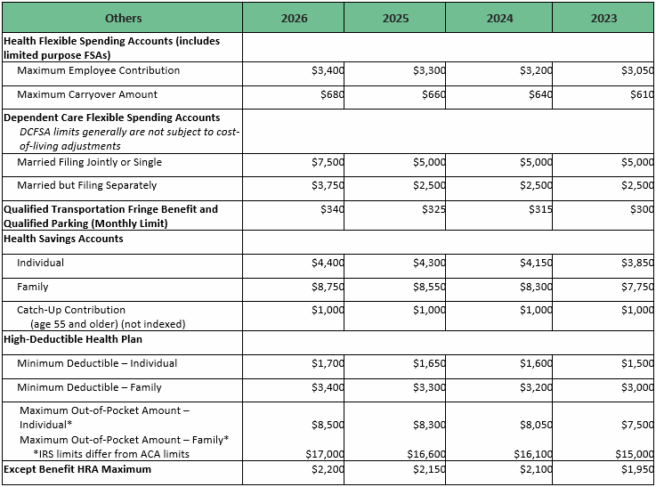

The table below provides the IRS and SSA limits for 2026† applicable to the various employer-sponsored retirement, welfare, and fringe benefit plans or programs listed below. The amounts for 2026 in the table below are based on information contained in IRS Notice 2025-67; IRS Rev. Proc. 2025-19; IRS Rev. Proc. 2025-32; One Big Beautiful Bill Act; and SSA Press Release (10.24.2025).

†The dollar limits in the table above are generally calendar-year limits; however, certain of the limits are applied based on a plan year, tax year or limitation year.

For further inquiries on the annual cost of living adjustments, contact Liskow attorney Robbie Mashburn and visit our Employee Benefits practice page on our website.