Last week, the Louisiana Department of Revenue (the “Department”) issued guidance regarding recent sales and use tax law changes.

Developments and Legal Issues Impacting Businesses in Louisiana, Texas, and Beyond

Last week, the Louisiana Department of Revenue (the “Department”) issued guidance regarding recent sales and use tax law changes.…

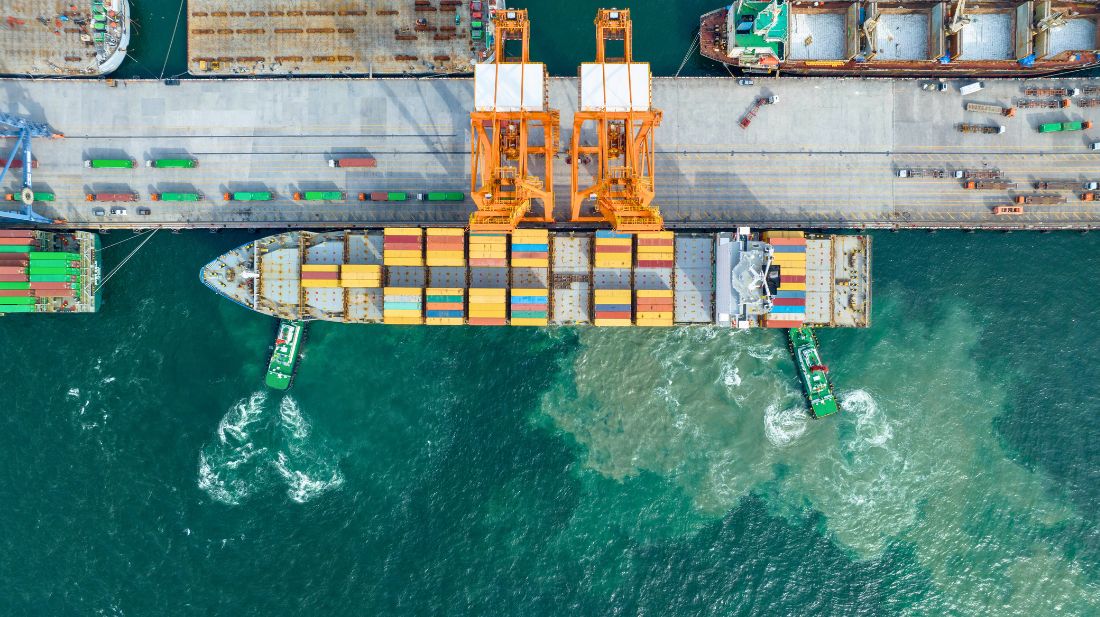

Governor Jeff Landry signed Act 384 into law on June 20, 2025, making changes to the sales and use tax provisions of the revised statutes. Included in the changes was an amendment to Section 305.1 of Title 47, which provides an exemption for certain vessel-related supplies and services. The ships and ships’ supplies exemption has…

While voters in Louisiana may have rejected all four of the constitutional amendments on Saturday’s ballot (the Secretary of State reported just over 21% voter turnout), including Amendment No. 2 which contained significant tax measures, efforts at tax reform are likely to resume during the Legislative Session that convenes next month.…

As we approach the year-end, taxpayers should consider the following amendments to regulations made by the Louisiana Department of Revenue earlier this year that go into effect today and on January 1st and the emergency rule regarding the following real and personal property regulations: LAC 61:V.703, 705, 901, 903, 907, 1007, 1103, 1301, 1303…