President Donald J. Trump signed the “One Big Beautiful Bill Act”, H.R. 1, 119th Cong., on July 4th, just one day after the House passed it on a 218-214 vote.

Developments and Legal Issues Impacting Businesses in Louisiana, Texas, and Beyond

President Donald J. Trump signed the “One Big Beautiful Bill Act”, H.R. 1, 119th Cong., on July 4th, just one day after the House passed it on a 218-214 vote.…

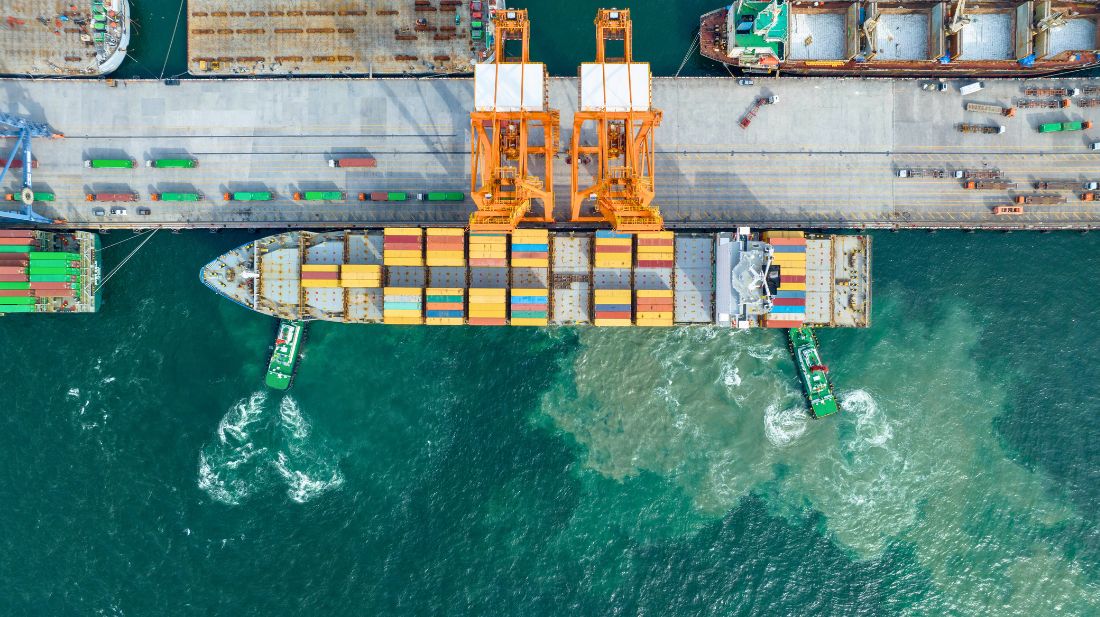

Governor Jeff Landry signed Act 384 into law on June 20, 2025, making changes to the sales and use tax provisions of the revised statutes. Included in the changes was an amendment to Section 305.1 of Title 47, which provides an exemption for certain vessel-related supplies and services. The ships and ships’ supplies exemption has…

Despite voters rejecting several tax-related constitutional amendments in a March referendum, the Louisiana Legislature has approved two new amendments to appear on the ballot next April. The two amendments would afford the Legislature more flexibility in developing budgets and making tax changes.…

While several bills were considered that would restructure the state’s severance tax scheme on oil and gas during Louisiana’s 2025 regular legislative session, three bills aimed to stimulate drilling activity and attract jobs in the energy sector were passed and sent to Governor Jeff Landry for his signature. …

On June 4, 2025, Governor Jeff Landry signed Act 44 into law, making changes to the state’s motion picture production tax credit program.…

On June 4, 2025, Governor Jeff Landry signed Act 82 into law, making changes to the definition of “marketplace facilitator” for nexus purposes.…

On June 5, 2025, the U.S. Supreme Court unanimously ruled that Wisconsin violated the First Amendment of the United States Constitution by denying a Catholic social ministry group the same unemployment tax exemption granted to churches and other religious organizations. The decision, authored by Justice Sonia Sotomayor, emphasized that the state’s refusal constituted religious discrimination…

It has been reported that the House tax committee’s draft bill to renew President Donald Trump’s tax cuts proposes to increase the state and local tax deduction to $30,000 for couples, but limits the write-off to households earning $400,000 or less.…

The IRS has obsoleted nine pieces of sub regulatory guidance in accordance with an executive order by President Trump to improve government efficiency by reducing regulations. In identifying the guidance documents for removal, the IRS determined that these guidance documents no longer provide useful information.

Among the guidance obsoleted by Notice 2025-22 is Notice 2015-73…

Several bills aimed at making changes to Louisiana severance tax laws were filed on Friday, the deadline for pre-filing bills to be considered during the Louisiana Legislature’s upcoming regular session, which is a fiscal one.…